NEWS

California Floating “Exit Tax” In 2024 To Stop Mass Wealth Exodus

Published

10 months agoon

Shutterstock

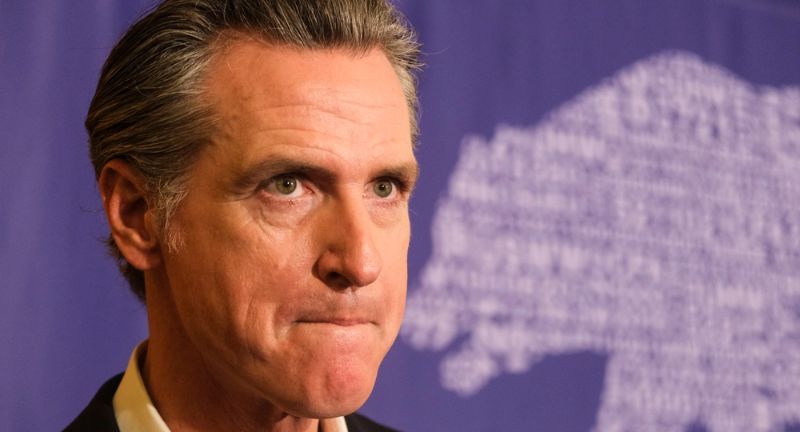

In 2024, California implemented a novel and debated financial policy known as the exit tax. This policy requires individuals who move out of the state to pay a tax based on their net worth, especially targeting those who have accumulated significant wealth within California. The exit tax is designed to curtail the outflow of wealth and ensure that departing residents contribute financially to the state, sparking widespread discussion and controversy.

Supporters of the exit tax argue it’s essential for funding vital public services and ensuring fiscal stability. However, opponents contend it’s a punitive measure that could have detrimental effects on California’s future by discouraging investment and settlement in the state.

Setting a Precedent

Shutterstock

California’s decision to implement an exit tax might inspire other states to consider similar measures, potentially leading to a variety of exit taxes across the United States. Such a scenario could complicate interstate relocations and impact the national economy, posing obstacles to mobility that contradict the principles of a unified economic framework.

Eroding Tax Base

Shutterstock

The exit tax may inadvertently speed up the departure of affluent individuals and businesses, which would erode the tax base it aims to preserve. As the tax base shrinks, remaining residents may face higher tax demands, potentially triggering a cycle of departures that could weaken the state’s financial health.

What Exactly Is The Tax?

Shutterstock

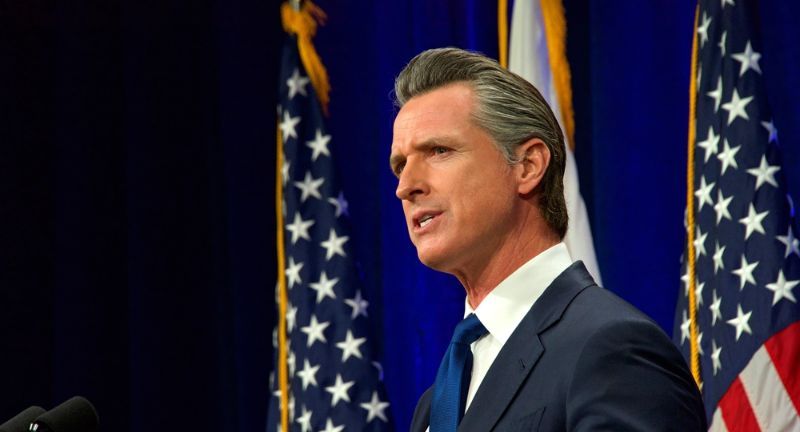

The exit tax in California is a component of legislative efforts to stem the wealth drain from the state, with significant measures like Assembly Bill 259 aiming to tax individuals and businesses departing California after accruing considerable assets. This legislation seeks to recover state tax benefits previously extended to residents and businesses, particularly targeting intangible assets such as stocks and cryptocurrencies, by considering them California assets for tax purposes even after relocation.

Proposed tax structures under discussion include a wealth tax of 1% on assets up to $1 billion and 1.5% on amounts exceeding $1 billion. However, these proposals face substantial legal and constitutional hurdles, primarily involving the Commerce and Due Process Clauses of the U.S. Constitution, which pose significant challenges to their enforcement.

Funding Public Services

Shutterstock

The exit tax aims to generate funding for critical but underfunded public services and infrastructure projects. By implementing this tax, California seeks additional revenues for sectors like healthcare, education, and transportation. Opponents, however, believe this strategy merely addresses symptoms of broader systemic financial problems without tackling the underlying causes of underfunding and inefficiency.

Fair Contribution

Shutterstock

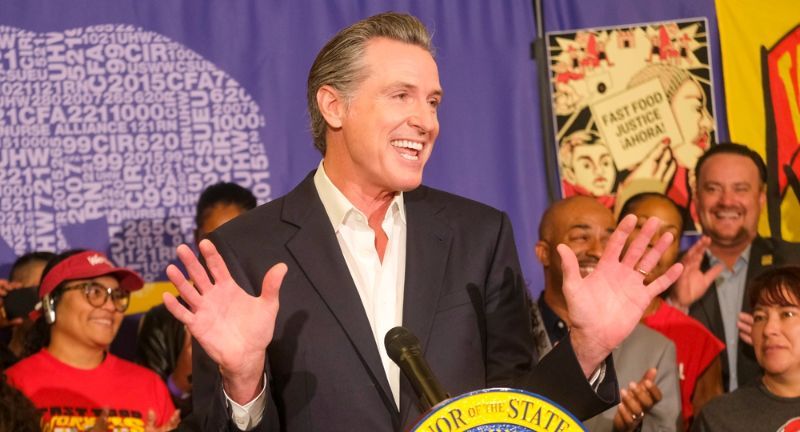

Advocates of the exit tax argue that it ensures those who have most benefited from California’s economic environment contribute equitably when they leave. The tax is designed so that wealth built up in the state is partially reinvested back into it upon departure. However, critics maintain that it unfairly penalizes success and curtails personal freedom, potentially deterring new residents and investors from coming to California.

Raising State Revenue

Shutterstock

California’s exit tax primarily aims to bolster state revenue. Facing a loss of residents to states with lower taxes, California introduced this tax to mitigate the financial impact of this exodus. Critics argue that this measure may actually accelerate the departure of wealthy individuals and businesses seeking more tax-friendly environments, thus potentially proving counterproductive.

Negative Perception

Shutterstock

The imposition of an exit tax fosters a negative view of California as being hostile to businesses and affluent individuals. This perception could deter economic growth and investment, potentially outweighing any immediate financial benefits from the tax. It may also reinforce the state’s reputation as heavily taxed and regulated.

Impact on Middle-Class Residents

Shutterstock

While the exit tax primarily targets the wealthy, it could also affect middle-class individuals seeking more affordable living conditions elsewhere. This demographic might encounter the tax as an unforeseen financial burden, complicating their moving plans and adding to their financial pressures during relocation.

Preventing Wealth Drain

Shutterstock

The state government has introduced the exit tax to prevent the outflow of wealthy residents and their capital from California. By imposing this tax, it hopes to deter such relocations. However, critics argue that this is merely a short-term solution that could discourage investment and settlement in the state, ultimately shrinking the tax base.

Administrative Complexity

Shutterstock

The introduction of the exit tax adds significant administrative complexities for both the state and those affected by the tax. The management and enforcement of this tax will require substantial resources, which may lead to inefficiencies and increased costs for taxpayers. This complexity compounds the challenges of California’s already intricate tax system, potentially detracting from its attractiveness to both residents and businesses.

Legal and Constitutional Concerns

Shutterstock

The legality of the exit tax is under scrutiny, raising concerns about its constitutionality and adherence to federal laws governing interstate commerce and taxation. This has led critics to predict potential legal challenges that could result in costly and prolonged court battles. Such uncertainty may further deter potential residents and investors from considering California as a viable option.

Alternative Solutions Overlooked

Shutterstock

The focus on implementing an exit tax diverts resources from exploring alternative methods to address California’s financial challenges. Critics suggest that comprehensive tax reform, improved spending efficiencies, and investment in sectors poised for economic growth would offer more sustainable solutions for enhancing state revenue and maintaining public services.

Discouraging Return

Shutterstock

The exit tax could dissuade former Californians from considering a return to the state, even under changed personal circumstances. The prospect of facing another tax upon leaving again could cause many to rethink relocating back, potentially reducing the influx of talent and investment that has traditionally benefited California.

Conclusion

Shutterstock

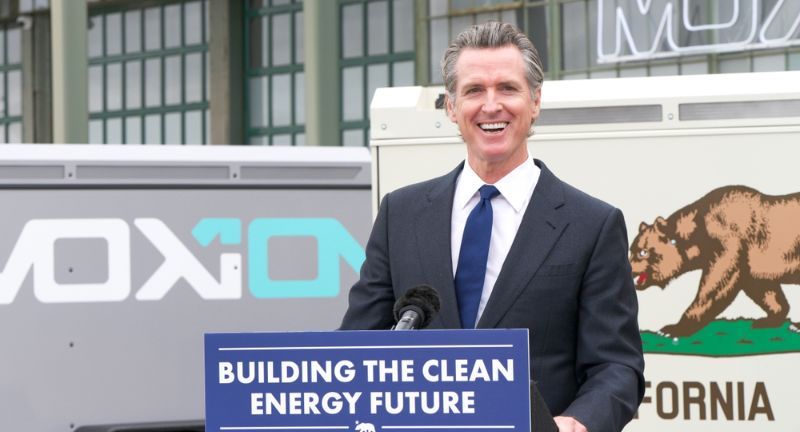

The California exit tax represents a bold initiative to address the state’s fiscal challenges, capturing the ongoing struggle between economic stability and individual liberties. As the debate over this policy unfolds, its long-term effects on population dynamics, investment attraction, and the overall economic landscape are yet to be fully assessed. The outcome of the exit tax will likely influence future state-level taxation and governance discussions nationwide.

More From Local News X

-

21 Things Retirees Should Never Buy At The Grocery Store

-

Escaped Killer Slips Search Perimeter in Pennsylvania, Manhunt Expands South

-

24 Amazing Benefits of Walking Daily

-

20 Things The Middle Class Won’t Be Able To Afford…

-

Humid, Foggy Weather Leads to Complications During Brooklyn Half Marathon,…

-

20 Clear Signs You Are Likely To Be Unhappy In…

-

18 Ways to Detect Water Damage in Your House

-

25 Shocking Discoveries Made In The Last 25 Years

-

19 Milestones That Show How Successful You’ve Been In Life

-

22 Common Health Mistakes That Could Ruin Your Retirement

-

Missouri Man Finally Gets His Day In Court 19 Years…

-

20 Careers That Are Likeliest To Lead To Divorce