ECONOMY

39 Ways To Make Better Spending Decisions Over Time

Published

3 months agoon

Shutterstock

Saving money doesn’t have to mean making drastic changes or sacrificing the things you love. Small adjustments in your daily habits can add up to significant savings over time. Still, this doesn’t mean we should be cutting out all or even most of our spending habits, since a few small changes is all it takes to make the rest of our budget look a lot larger. In this guide, we’ll explore a variety of practical tips to help you save without compromising on your lifestyle.

Cook meals at home

Shutterstock

Cooking meals at home is one of the simplest ways to save money (and improve your health). By preparing your own food, you avoid the high costs associated with dining out, but also gain full control over the ingredients and their quality. This means you can experiment with healthier recipes and even learn new cooking skills. Plus, the satisfaction of eating something you’ve made with your own two hands is priceless!

Brew coffee instead of buying it

Shutterstock

Instead of spending $5 on a latte every morning, consider investing in a good coffee maker and brewing your own. You’ll be surprised at how much you save over the course of a month. Plus, brewing coffee at home allows you to customize your drink exactly the way you like it. Think of it as your daily dose of savings with an extra splash of creativity.

Use public transportation

Shutterstock

Ditching your car for public transportation can save you hundreds in gas, maintenance, and even parking fees. Buses, trains, and subways are often much cheaper alternatives to driving, especially in urban areas. Additionally, you’ll also contribute to reducing traffic congestion and your carbon footprint. Plus, you can use the commute time to read, listen to podcasts, or simply relax! It’s a win-win.

Switch to a cheaper phone plan

Shutterstock

Phone plans can be a significant monthly expense, but in almost every case, there’s often a better deal waiting if you’re willing to look. Compare plans from different providers and consider switching to one that offers all the features you need at a marked-down price. You might even find that a prepaid plan or a family bundle saves you even more and still provides the necessary services for your individual needs. Keeping in touch shouldn’t mean breaking the bank!

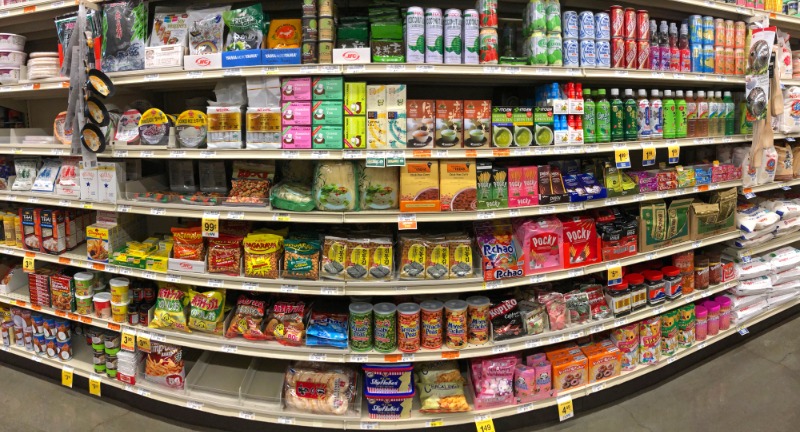

Buy in bulk

Shutterstock

Buying in bulk can significantly reduce your cost per unit, especially for non-perishable items that you can store for long periods of time. Stocking up on essentials like rice, pasta, or (on a less edible note) cleaning supplies ensures you’re prepared while saving money in the long run. Certain warehouse clubs and discount stores often offer unexpectedly incredible deals for bulk purchases. With buying in bulk, the only thing to avoid is overbuying items that might expire or go unused. Every other factor works entirely in your favor!

Use coupons and promo codes

Shutterstock

Coupons and promo codes are an easy way to stretch your dollars without sacrificing quality, since you’re ultimately buying the same product anyway. Check online platforms, store websites, and even apps dedicated to finding discounts. Combining sales with coupons can lead to substantial savings on those small, everyday purchases that add up over time. The only reason to not search for coupons is that it’s a small amount of extra work, so to avoid this, think of it as a modern treasure hunt, where every code is a small victory for your wallet.

Shop secondhand

Shutterstock

Secondhand shopping isn’t just for thrifty people—it’s a great way to find unique items at unbeatable prices. Whether it’s clothing, furniture, or electronics, there’s no denying that thrift stores and online resale platforms offer excellent deals. Shopping this way also helps reduce waste, giving items a second life instead of sending them to landfills. Plus, the thrill of finding a hidden gem makes it a fun and rewarding experience. There’s a reason people take up thrifting as a hobby!

Reduce electricity usage

Shutterstock

Cutting down on electricity is easier than you think—and no, it doesn’t require living like you’re in the 1800s. Start by turning off lights when you leave a room (your parents were right about that one). Swap out your power-hungry gadgets for energy-efficient alternatives and let your appliances rest when they’re not working hard for you. You’ll not only shrink your bills but also earn a feeling of smugness for helping save the planet.

Meal prep for the week

Shutterstock

Meal prepping is a fantastic way to save money and avoid the temptation of takeout. By planning and preparing your meals in advance, you can buy ingredients in bulk and avoid wasting food. Not only does it save time during the busy workweek, but it also ensures you’re eating healthier, home-cooked meals. With just a little effort upfront, you’ll see both your wallet and your schedule thanking you!

Avoid impulse purchases

Shutterstock

Impulse purchases can quickly drain your budget and clutter your home with unnecessary items that you regret purchasing later. To avoid this, practice the 24-hour rule—wait a day before buying anything you didn’t plan for. Often, the desire fades, and you realize you don’t need the item after all. Even if this isn’t the case, the product will be waiting right there for you on the shelf anyway. This small habit can lead to big savings and more mindful spending.

Pay bills on time to avoid late fees

Shutterstock

Late fees are an unnecessary expense that can easily be avoided with timely payments. Set up reminders or automate your bill payments to ensure nothing slips through the cracks. These fees may seem small, but they add up over time and can even impact your credit score in a shocking way. A little organization goes a long way toward keeping your finances on track.

Unplug electronics not in use

Shutterstock

Electronics continue to draw power even when they’re turned off, a phenomenon known as phantom energy use. Unplugging devices when they’re not in use can cut down your electricity bill significantly. Use a power strip to make it easier to switch multiple devices off at once. This simple habit is a small effort that results in noticeable savings over time.

Compare insurance rates

Shutterstock

Insurance premiums can vary widely and your options can change surprisingly frequently, so it pays to shop around and compare rates regularly. Look for discounts or bundling options that might lower your overall costs. Even a small reduction in your monthly premium can lead to substantial annual savings. Try to stay informed to the best of your capability, since it ensures you’re not overpaying for coverage you may not even need.

Grow your own vegetables

Shutterstock

Growing your own vegetables is a fun and cost-effective way to cut grocery bills. A small garden or even a few pots on a balcony can yield a surprising amount of fresh, delicious produce. Not only will you save money, but you’ll also enjoy the satisfaction of eating food you’ve grown yourself. Plus, on its own, gardening can be a relaxing and rewarding hobby!

Avoid name-brand products

Shutterstock

Name-brand products often come with a weirdly high price tag, even if many generic versions are just as good. Store-brand items, from food to medicine, typically offer the same quality, just at a fraction of the cost. To make sure that these brands don’t sacrifice quality, you can always try comparing ingredients or specifications to help you make smart choices. By going generic, you’ll free up your budget for other priorities that you may appreciate more down the road.

Negotiate rates for services

Shutterstock

Many service providers, from cable companies to internet providers, are willing to do anything they can to retain customers, even if that means lowering rates in an individual case. A quick and simple phone call to ask about discounts or promotions could save you a significant amount each month. Don’t forget to mention competitor rates as leverage to strengthen your case!

Plan grocery shopping with a list

Shutterstock

Heading to the grocery store with a list helps you stick to your budget and avoid unnecessary purchases. Take a few minutes to plan meals and write down what you need before shopping. This prevents overspending on items you don’t need and stops you from buying a product that you already have at home. It’s a simple yet effective way to save money and reduce food waste.

Use a reusable water bottle

Shutterstock

Buying bottled water might seem convenient, but the cost quickly adds up over time. Consider investing in a durable, reusable water bottle and refilling it at water fountains throughout the day (which is entirely free!). Not only will this save you money, but it’s also an eco-friendly choice that reduces plastic waste. Plus, you’ll always have water on hand, keeping you hydrated and prepared wherever you go.

Avoid ATM fees

Shutterstock

ATM fees might seem minor, but they can add up quickly if you’re withdrawing cash frequently. Avoid these charges by using ATMs within your bank’s network or planning ahead to withdraw enough cash during bank visits. Many banks also offer fee-free ATM options through partner networks, so don’t forget to explore your bank’s policies. Keeping an eye on these fees is an effortless way to save money.

Carpool when possible

Shutterstock

Carpooling is a fantastic way to cut down on commuting costs like gas, tolls, and even maintenance needs for your car. Sharing rides with coworkers, friends, or neighbors reduces wear and tear on your vehicle as well. It’s also an eco-friendly option that minimizes traffic congestion and pollution. Plus, carpooling can make your commute more enjoyable with good company.

Rent or borrow instead of buying

Shutterstock

For items you’ll only use occasionally, consider renting or borrowing instead of purchasing. From power tools to party supplies, borrowing can save you significant money. Check out rental services or ask friends and family before committing to a purchase. This approach is cost-effective and has the added benefit of preventing unnecessary clutter in your home.

Track your spending

Shutterstock

Tracking your spending is the key to understanding where your money goes each month. Use budgeting apps or even just a simple spreadsheet to categorize expenses and identify areas where you can and should be cutting back. Small leaks in your finances, like frequent takeout or subscription services, become much more obvious when they’re tracked. This awareness empowers you to make better financial decisions, stick to your budget, but also retain more spending power in the long run.

DIY home repairs

Shutterstock

Simple home repairs, like fixing a leaky faucet or patching a hole in the wall, can often be done without hiring a professional. With online tutorials and basic tools, many projects become manageable and even rewarding. DIY repairs save you money and give you a sense of accomplishment. Just ensure you know your limits—some jobs are better left to the pros!

Choose free entertainment options

Shutterstock

There are countless free entertainment options to enjoy without spending a dime. Visit local parks, attend free community events, or explore public museums on free admission days. Libraries also offer books, music, and even movies at no cost. With a little creativity, you can have the same or even more fun while keeping your budget intact.

Limit dining out

Shutterstock

Dining out frequently can take a huge bite out of your budget. Instead, reserve eating out for special occasions and focus on cooking at home for regular meals. You’ll save money while enjoying healthier, home-cooked dishes. If you do go out, look for deals like happy hours or discounted specials to help keep costs down.

Set a strict monthly budget

Shutterstock

Creating and sticking to a monthly budget is one of the most effective ways to manage your money. Start by calculating your income and fixed expenses, then allocate funds for savings and discretionary spending. Regularly review and adjust your budget as needed to stay on track. With discipline, a solid budget helps you achieve financial goals without overspending.

Skip gym memberships; exercise at home

Shutterstock

Gym memberships can be pricey, especially if you’re not using them regularly. Instead, create a workout routine at home using free online videos, apps, or by just listening to what your body is telling you. Bodyweight exercises, yoga, and even household items can serve as great fitness tools. You’ll save money while still staying active and healthy.

Use energy-efficient light bulbs

Shutterstock

Switching to energy-efficient light bulbs, like LEDs, can lower your electricity bill significantly. These bulbs use less power and last much longer than traditional incandescent ones, reducing replacement costs as well. While they may cost more upfront, the long-term savings far outweigh the initial investment. It’s a simple, eco-friendly step toward saving money on utilities.

Declutter and sell unwanted items

Shutterstock

Decluttering your home can uncover a treasure trove of items you no longer need but others might want. Sell these on platforms like eBay, Facebook Marketplace, or at a yard sale to earn extra cash. Not only does this help your wallet, but it also frees up space and makes your home more organized. It’s a win-win for your finances and your living environment.

Delay large purchases

Shutterstock

Waiting before making big purchases gives you time to consider if the item is truly necessary. Research prices and look for sales to ensure you’re getting the best deal. Often, the desire to buy fades with time, saving you from impulsive decisions. When the price is that high, your caution should be even higher.

Use a programmable thermostat

Shutterstock

A programmable thermostat lets you optimize your home’s temperature to save on energy costs. Set it to lower the heat or air conditioning when you’re asleep or away from home. Over time, this reduces your energy consumption and lowers utility bills. It’s a simple upgrade that speaks for itself when it comes to savings.

Avoid credit card interest

Shutterstock

Carrying a credit card balance can lead to one of the highest interest charges that can eat right through your budget. Pay off your balance in full each month to avoid these unnecessary costs. If you’re already in debt, focus on paying more than the minimum payment to reduce interest faster. Managing credit wisely keeps more money in your pocket.

Learn basic sewing for repairs

Shutterstock

Knowing how to sew allows you to repair clothes instead of replacing them. Fixing a tear, sewing on a button, or adjusting a hem can extend the life of your garments. You’ll save money and reduce waste by avoiding frequent replacements. Plus, it’s a handy skill that you can turn into a fun and practical hobby!

Avoid extended warranties

Shutterstock

Extended warranties often sound like a good idea up-front but are typically not worth the added cost. Many products already come with sufficient manufacturer warranties, and credit card protections may cover additional issues. Instead of buying an extended warranty, consider saving that money for potential repairs or replacements. Most of the time, you won’t need it, and the extra cash stays in your pocket for more important spending choices down the line.

Reduce driving to save on gas

Shutterstock

Driving less is a simple way to save on fuel costs and reduce wear on your vehicle. Combine errands into one trip, carpool when possible, or use public transportation. Walking or biking for short distances not only saves gas but also promotes a healthier, more active lifestyle. By cutting back on driving, you’ll begin to see noticeable savings in your monthly expenses.

Borrow books from the library

Shutterstock

Libraries offer a treasure trove of books, audiobooks, and even eBooks—all for free. Borrowing instead of buying saves money and reduces the clutter in your home. Many libraries also provide access to movies, magazines, and educational programs. Supporting your local library is a cost-effective way to access and enjoy endless entertainment and knowledge.

Pack your own snacks for outings

Shutterstock

Purchasing snacks on the go can be surprisingly expensive, especially at events or attractions. Packing your own snacks beforehand saves money and ensures you have something you enjoy eating. Choose healthy and portable options to keep hunger at bay while staying on budget. This small habit can lead to significant savings over time, especially for larger families.

Avoid convenience stores

Shutterstock

Convenience stores may live up to their name, but their prices are often significantly higher than those of regular grocery stores to compensate. Whether it’s snacks, drinks, or household essentials, these small purchases add up quickly. Plan ahead and buy what you need during regular shopping trips to avoid paying premium prices. By steering clear of these costly pit stops, you’ll save money without much effort.

Take advantage of loyalty programs

Shutterstock

Loyalty programs are an easy way to earn rewards and discounts at stores you already frequent. Many programs offer points for purchases, exclusive discounts, or even free items after a certain amount is spent. Signing up is often free, and the savings can accumulate over time. Don’t forget to keep track of your rewards to ensure you use them before they expire!

Conclusion

Shutterstock

By implementing even just a few of these money-saving tips, you’ll start to notice a positive change in your finances. Saving doesn’t require a complete overhaul of your lifestyle, but rather slowly implemented choices that are consistent and mindful. Every small step counts. Stick with these habits, and you’ll soon find yourself with more money to save or invest in the things that truly matter.

More From Local News X

-

25 Challenges Kids Are Facing Now That They Didn’t Face…

-

The Evolution Of Technology From The 1950’s To Now

-

25 Strangest World Records That Don’t Seem Real

-

22 Movies Throughout History That Have Shaped The Children’s Toy…

-

20 Facts About The Olympics That Might Surprise You

-

If You’re In Credit Card Debt, Do These 33 Things…

-

17 U.S. Cities Where Second Home Buyers Are Driving Up…

-

A Boomer’s Guide To Retirement, 25 Tips To Be Prepared…

-

20 Most Common Home Renovations People Make Within The First…

-

22 Top Things To Consider Before You Pack Up And…

-

25 States That Have The Happiest People

-

25 Most Influential Inventions That Baby Boomers Have Witnessed Come…