NEWS

12 Startling Reasons Why California’s Rich Are Fleeing the State

Published

9 months agoon

Shutterstock

The departure of affluent Californians has become a captivating trend, sparking discussions nationwide. Attracted by lower tax burdens, a more conducive business environment, and a better overall quality of life, these individuals are relocating. Their move is a clear indicator of their preferences, as they seek more favorable conditions in states like Texas and Florida.

The significant migration of the wealthy from California highlights an economic transition driven by personal and financial motivations. By examining the underlying reasons for their departure, we gain insight into the values and challenges that influence the decisions of wealthy Californians today. It reveals a compelling narrative about the interplay between financial policies and personal contentment.

Estate Planning and Inheritance Tax Concerns

Shutterstock

California’s complex legal system and the federal estate tax implications can be significant obstacles in estate planning for the wealthy. The absence of a state estate tax does not alleviate the burdens of high federal taxes and complex probate procedures, leading many to relocate to states with more favorable tax regimes. Such strategic moves are aimed at preserving wealth and ensuring its transfer to future generations with minimal tax liabilities.

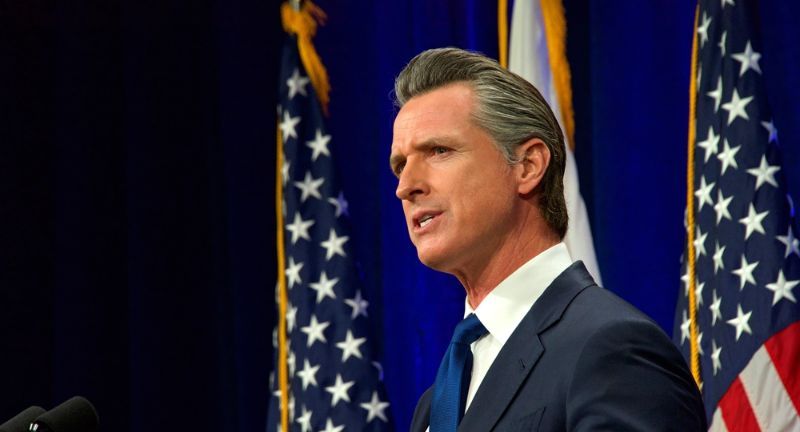

Political Climate

Shutterstock

California’s political landscape is increasingly seen as divisive, often not aligning with the fiscal and social preferences of its wealthier residents. The state’s policies can influence crucial aspects like tax regulations and business climates, prompting some to relocate to states where their views and economic interests are more likely to be supported. This migration is motivated by a search for a political climate that aligns better with their personal and economic preferences.

High Tax Burden

Shutterstock

California’s high state income tax rates significantly impact its wealthier residents. Driven by the financial strain of these taxes, many choose to establish residency in states with lower or no state income tax. Over time, the savings can amount to millions, enhancing the appeal of tax-friendly states such as Nevada, Texas, and Florida. Such tax structures have a profound effect on personal wealth and investment decisions.

Real Estate Market Volatility

Shutterstock

The volatility of California’s real estate market, known for its high costs and unpredictability, often leads wealthy individuals to reconsider their investment strategies. Fearing a downturn, many choose to sell their high-value properties at market peaks. They look for more stable and less expensive markets in other states, where they can protect and grow their investments more reliably.

Business Climate Concerns

Shutterstock

Although California is a hub for technology and innovation, its regulatory environment is often viewed as prohibitive for businesses. High costs, strict regulations, and complex legal requirements discourage investment, prompting companies and their wealthy owners to relocate. This shift not only impacts their wealth but also redistributes job opportunities and economic activities to more business-friendly states.

Public Services and Infrastructure

Shutterstock

Despite high taxation, the quality of public services such as education, healthcare, and infrastructure often falls short of expectations in California. Wealthy residents, seeking the best for their families, are drawn to states that offer superior services, providing more value for their tax dollars. This move is frequently driven by the desire to access better educational opportunities, healthcare facilities, and well-maintained infrastructure.

Overcrowding and Quality of Life Issues

Shutterstock

California’s urban centers are notorious for high population density, resulting in significant congestion and long commutes. This has prompted affluent individuals to seek better living conditions in states offering more space and a higher quality of life. Such states attract those desiring a calmer, more spacious environment, especially if remote work options are feasible.

Cost of Living

Shutterstock

Living in California’s major urban areas is particularly expensive, with costs that surpass most of the nation. The high expenses impact the disposable income and savings of the wealthy, making other states with lower living costs more attractive. Relocation often results in increased financial freedom, enabling further investment and wealth accumulation opportunities in more economically friendly environments.

Environmental Concerns

Shutterstock

Frequent natural disasters such as wildfires, earthquakes, and droughts raise substantial concerns in California, influencing the decisions of the wealthy to relocate. The risk to property and personal safety, coupled with high insurance costs, makes less hazardous regions more appealing. Moving to such areas can result in lower insurance costs and a more secure living environment.

Lifestyle and Recreational Preferences

Shutterstock

The lifestyle and recreational offerings in other states often attract wealthy Californians looking for new experiences. Regions offering distinct climates, varied landscapes, and unique leisure activities offer fresh alternatives to California’s environment. This allure is strong among those who value diversity in their living conditions and recreational pursuits, prompting them to relocate for a change of scenery.

Philanthropic and Community Engagement Opportunities

Shutterstock

A desire for deeper community engagement and impactful philanthropy drives some wealthy individuals to relocate. Smaller or different states can offer a closer-knit community atmosphere, providing unique opportunities for meaningful local involvement. This move often stems from the desire to see a direct impact from their contributions, something that can be challenging in California’s vast and densely populated settings.

Economic Diversification Opportunities

Shutterstock

The need for economic diversification drives some wealthy Californians to seek investment opportunities elsewhere. Other states may offer more advantageous investment climates, particularly in areas like real estate, business ventures, and other markets less saturated than those in California. Such diversification is crucial for maintaining economic stability and fostering growth, making relocation a prudent financial strategy.

Conclusion

Shutterstock

The exodus of affluent residents from California marks a significant chapter in the state’s economic and social narrative, sparking a broader conversation about taxation, governance, and living standards. As these individuals explore new environments, their movements shed light on the evolving dynamics between prosperity and geographic location.

This migration not only affects the financial stability of California but also prompts a reassessment of strategies to attract and retain top talent and capital. By understanding the reasons behind these relocations, policymakers can devise strategies that address the needs of all residents, ensuring that states remain dynamic, diverse, and economically robust.

More From Local News X

-

Concerned Parents Await Their Children at a Reunification Site in…

-

27 Foods Most People Don’t Know Are Banned In America

-

21 Money Traps Draining Retirees’ Savings

-

20 Millennial Habits That Are Negatively Impacting The Economy

-

Florida Is Attracting More Young And Wealthy Newcomers Than Any…

-

Structure fire south of downtown Omaha

-

22 Strategies for Keeping Your New Year’s Promises

-

25 Classic Movies That Are Worth Seeing At Least Once

-

20 Baby Boomer Values That Have Been Rejected Today

-

25 Things Retirees Should Avoid Wasting Money On At All…

-

22 Important Costs Retirees Fail To Plan For

-

19 Milestones That Show How Successful You’ve Been In Life